University of Oregon Athletic Program Budget Analysis

Introduction:

The University of Oregon Athletic Department (UOAD) operates in a dynamic and increasingly competitive collegiate sports landscape where sports programs' success is heavily dependent on the department's financial decision-making as well as their yearly revenue streams. This paper seeks to evaluate the department's financial framework, beginning with an analysis of its primary revenue streams: ticket sales, contributions, and media rights. By examining individual fiscal years 2019 and 2022 we will be able to identify trends in spending & revenue as well as implications on future decision-making and explanations of past history based on these spending habits. How these revenue sources interact and compare across different sports will be central to understanding the program’s stability and areas for improvement.

We will aim to evaluate how yearly trends in the UOAD’s cost structure and revenue streams can influence decision-making for future generations while analyzing what these same trends meant for the athletic program in the past. By doing so, this research will highlight topics such as the implications on women's sports, the University’s transition to the B1G10, and the budget’s keen reliance on private donor support. In light of these findings, we will propose actionable recommendations for the Athletic Director to address current concerns, avoid past mistakes and position the program for success in an evolving collegiate sports environment.

Primary Revenue:

University of Oregon Athletics has received a rapid amount of growth from 2019 to 2022, with this growth only increasing after a huge move to the B1G 10 in 2024. Football and men’s basketball provide a large majority of the revenue for each fiscal year with almost 60% of total athletic program revenue coming from these 2 sports in 2022 and 65% of the total revenue in 2019. In 2022 the Oregon Football team was ranked #11 in the country during the preseason finishing at #15, which by most standards is a lackluster season. Similarly, the men's Basketball team was ranked #21 during the preseason and finished unranked to end the season. Based on these two facts, it would be unclear as to why their total revenue in the athletic program increased by almost $40 million. This is simply because the success of a program is not the end-all-be-all for collegiate sports programs. To further prove our case we’ve analyzed both the success and financial budgets of both the University of Oregon and the University of Washington’s men's football programs since both teams have had relative success and were in the same conference.

Primary Revenue Fiscal Year 2019:

During the 2019 season, the University of Oregon football team was also ranked #11 during the preseason and finished at #5, constituting a successful season for the program. However despite this success ticket sales during the 2019 season were down $4 million from the previous year where the team finished unranked. Ticket sales were also down for men's basketball after a successful season (#15 preseason & #13 finish). However, both contributions and media rights revenue went slightly up from both of these respective sports, indicating that team success doesn’t directly translate to better ticket revenue or program success, but it can influence individual media companies and rich alumni to invest more into their respective athletic program, perhaps investing slightly in the future.

Now comparing these findings to the University of Washington’s football team in 2019 they were clocked in at #13 during the 2019 preseason and finished unranked. Despite this, the athletic program saw a $9 million profit in their athletic program revenue, despite football representing over 66% of this revenue(Appendix 1). On top of this, football ticket sales specifically accounted for $30 million in 2019 following an unranked finish. Comparatively in 2018 the Huskies were a preseason #6 and finished #13th, a more successful season than the following year but the money doesn’t indicate that this means anything as they only had $25 million in ticket sales after a much better finish. This trend for football also reflected upon the entire athletic program as in 2018 they profited only $2 million as a program (Appendix 2) whereas in 2019 they profited around $9 million.

This trend applies to some pro sports as well, where we see teams that are worth billions of dollars do not have any recent success and a lot of this is due to media rights deals and fan markets being incredibly large and loyal. A good reason why this applies to the University of Oregon is because there are no other football teams in Oregon, the Ducks encapsulate the entire market and have done so for a long time now, so their success isn’t as volatile since they’ve already taken advantage of the market. Not only have UW and UO created a large and loyal fanbase that provides increased donations and media rights, but they’ve both transitioned to the B1G 10 conference which will translate to significant increases in both of those categories. To recap, success in a given year doesn’t directly translate to increased revenue in that year, and the budget supports this theory, however, success is essential for the long-term value of the program which we will touch on further with coaching and equipment expenses in particular.

Expenses Fiscal Year 2022:

Equipment Expenses:

Analyzing men's basketball, women’s basketball and football’s expenses for the 2022 fiscal year will provide more accurate data when trying to represent how we view these numbers to change in the following years. In terms of equipment, football spent over $2 million which was more than 9x what Men’s Basketball spent ($222k) and what Women’s Basketball spent ($201k). Oregon athletics is widely known for wearing a multitude of different and unique uniform combinations and have revolutionized collegiate sports in this way being one of the only teams to do so. On the flipside it also accounted for 5% of the football programs expenses, 2% of the men's basketball expenses and 4% of the women’s basketball expenses. This raises the question: is it worth it for UO to continue pouring money into equipment and uniforms even if it could negatively affect funding for the rest of their athletic programs expenses? They think the answer is yes since they show no sign of stopping this trend and admittedly, the money follows this line of thinking. Discontinuation of this particular expense to an average number means Oregon loses a marketing spark and upset fans, donors and media, ultimately tanking huge portions of revenue.

Coaching Salaries:

Oregon football spent $14,756,555 in coaching and staff salaries in 2022, accounting for a massive 36% of their expenses for that year. Despite this, that number isn’t an anomaly among Oregon sports as men's basketball coaching salaries accounted for $6,437,900 (58.7% of expenses) and womens basketball accounted for $2,134,415 (42% of expenses). But why? It’s because history shows that a good coach is the catalyst for not only team success, but connection for fans and most importantly the value of a program. The most ideal example of this being the case is with Duke men's basketball, as in 1980 they hired Coach Krzyzewski, one of the most decorated coaches ever. At the time Duke’s basketball program was mediocre at best for over 20 years prior to Coach K, as he would come in and win 5 national championships with countless deep playoff runs over a 25 year stretch. As a result of this long term success, a 2012 report shows that Duke men's basketball skyrocketed in value since the hiring of Coach K in 1980, stating “the biggest growth in total value belongs to the fourth-ranked Duke Blue Devils. The team's value increased by 52% since the last time we published our list in 2010”. This makes the margin of error for success so razor thin that programs are willing to pay huge lump sums of cash to fire their coaches, also known as buyout clauses. Therefore the implications of having a good coach are proven to be a catalyst for increased program value in the future, as this investment is warranted since we know collegiate sports aren’t leaving us anytime soon and will continue this way until the market shows otherwise.

Womens Sports:

Current Financial Performance

The current financial performance of women’s sports, specifically women’s basketball, has shown consistent growth with some interesting trends and highlights areas for improvement. In the past, women’s basketball has experienced steady revenue growth until 2021 where due to COVID, revenue decreased from $2,263,973 to $584,939. This was a temporary setback and has now been back on track increasing yearly. Although expenses are also increasing consistently year over year this shows growth in various aspects of the sport including the increase in coaching salaries, travel, and overall expenses. This demonstrates that there seems to be a rise in investment in women’s basketball. For example, contributions to women’s basketball saw a significant jump from 2020 to 2021 increasing from $100,000 to $250,000. Looking back to the 2015 and 2016 seasons, no contributions were recorded, which suggests growing interest and support for the program.

Future Performance

Currently, the collegiate sports market doesn’t provide profitability for most women’s sports. Still, looking ahead it is likely that the financial growth of women’s basketball will increase because of the increased exposure and investment. However, the development of other women’s sports may take longer to increase because of the lack of exposure and investment currently. Volleyball, for example, has the potential to expand its financial performance because currently, certain regions in the United States have already established support and stable revenue streams. Looking specifically at Nebraska and its volleyball program shows there is a fan base and donor base to compete in bringing in revenue for the university. In 2023 Nebraska Volleyball was able to fill up Memorial Stadium with 92,003 fans to watch a preseason match which surpassed the previous women’s sporting event record of 91,648. This demonstrates the fan base is crucial to the success of this program, since in the 2021-22 season, the program brought in $2.12 million in ticket sales alone.

Not only does Nebraska's volleyball program attract a large number of fans at home, but its fans also travel along with them. Unlike women’s basketball where growth has been attributed to standout players like Caitlin Clark or Paige Bueckers due to investment in those individual players, Nebraska’s fan base doesn’t rely on individual players but rather the team and program itself. This program has the opportunity to create that same growth effect for the entirety of women's volleyball. For example, in the latest season, Nebraska faced Oregon at Matthew Knight Arena (MKA) which was a top-15 matchup that held a record crowd of 8,566 which shattered MKA’s previous attendance record of 7,334 during the previous season. Nebraska also was able to break the attendance record when traveling to Maryland. They set a record of 13,071 which was almost triple the previous record of 4,522 back in 2014. Maryland was never ranked throughout the season which highlights how even when competing against lesser competition Nebraksa still is able to bring in fans. It also shows they can do this on a national level, from Oregon to Maryland they bring visibility. Nebraska is one of the few programs in the United States to achieve this level of marketability and exposure with an entire team as opposed to individuals. Nebraska provides an example of how other women’s collegiate sports that are traditionally less popular in demand can provide revenue for the university.

Private Donor Support:

The University of Oregon's Athletic Department currently utilizes contributions as one of the main forms of revenue for football and basketball behind media rights. Other sports do not get as much, but there are significant contributions to the general fund (non-sport specific). For example, in football in 2023 $17,160,622 million was given in contributions and total revenue was $20,318,235. These contributions are crucial to maintaining the financial stability of the programs and offsetting the expenses, as Phil Knight is the main contributor towards athletics. Most notably, he has helped in providing state-of-the-art facilities like Matthew Knight Arena and the renovated Hayward Field, but this begs the question of how this will change in his passing.

The University of Oregon has simply relied on Phil Knight for decades and because of these contributions it could impact the financial stability of athletics. Simply put, not every school has a Phil Knight where they won’t have to worry about being in a deficit as a program or about NIL money because of an unlimited allowance. Oregon relies on Phil so much to the point where his donations are an outlier in comparison to the field, and the school cannot depend on this forever. The move to the B1G 10 will help generate revenue outside of donations, and the school is banking on this to level out the primary revenue for the future. It is also difficult to predict how other donors will contribute each year and if they will remain consistent, especially with unexpected economic struggles, like COVID for example.

Potential Short-Term Critical Challenges:

Based on our analysis of the budget and the trends on how the UO athletic department spends its money, we can identify a few potential short-term challenges they must account for. Firstly, NIL landscape implications could mean costs get driven up in the short term in order to compete with programs that have a larger budget and alumni base to pull from. We’ve seen just recently the NIL landscape be shaken up with the Dept. of Education making an official statement that athlete pay must follow Title IX provisions. In its short history, NIL has dominated mens sports fields but with this provision in place, programs need to fund equal opportunities for women's sports as well which we predict will raise expenses dramatically.

The B1G 10 Transition

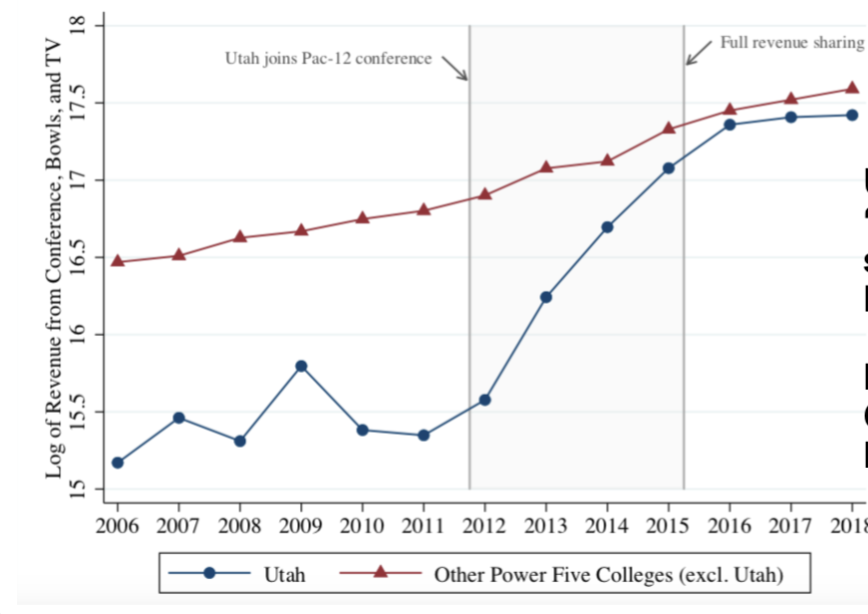

The switch from the PAC-12 to the B1G 10 for Oregon is a crucial point in the schools athletic history, as it carries major financial implications for the future. Although Oregon has already seen athletic success in this conference, one small challenge they’ll have to overcome is not being able to capitalize on the pooled conference media, bowl game and TV deals that the B1G 10 has to offer as Oregon (and others) get phased in. We’ve seen this example before in the past where when Utah joined the PAC-12, they weren’t able to capitalize on these same deals from 2011-2015 (Appendix 3). Oregon will have to survive without this boost in revenue for a short period of time, which may prevent them from scaling as rapidly as we might hope.

Potential Long Term Critical Challenges:

In terms of long-term challenges, we spot two main catastrophes to avoid, as we can use other programs' downfalls as a learning moment to not repeat history. We’ve seen recently where UOAD is still paying off projects such as Matthew Knight Arena and Hayward Field renovations that had the potential to cripple the programs budget for the long run, if ample donor support wasn’t present or if budgeted wrong.

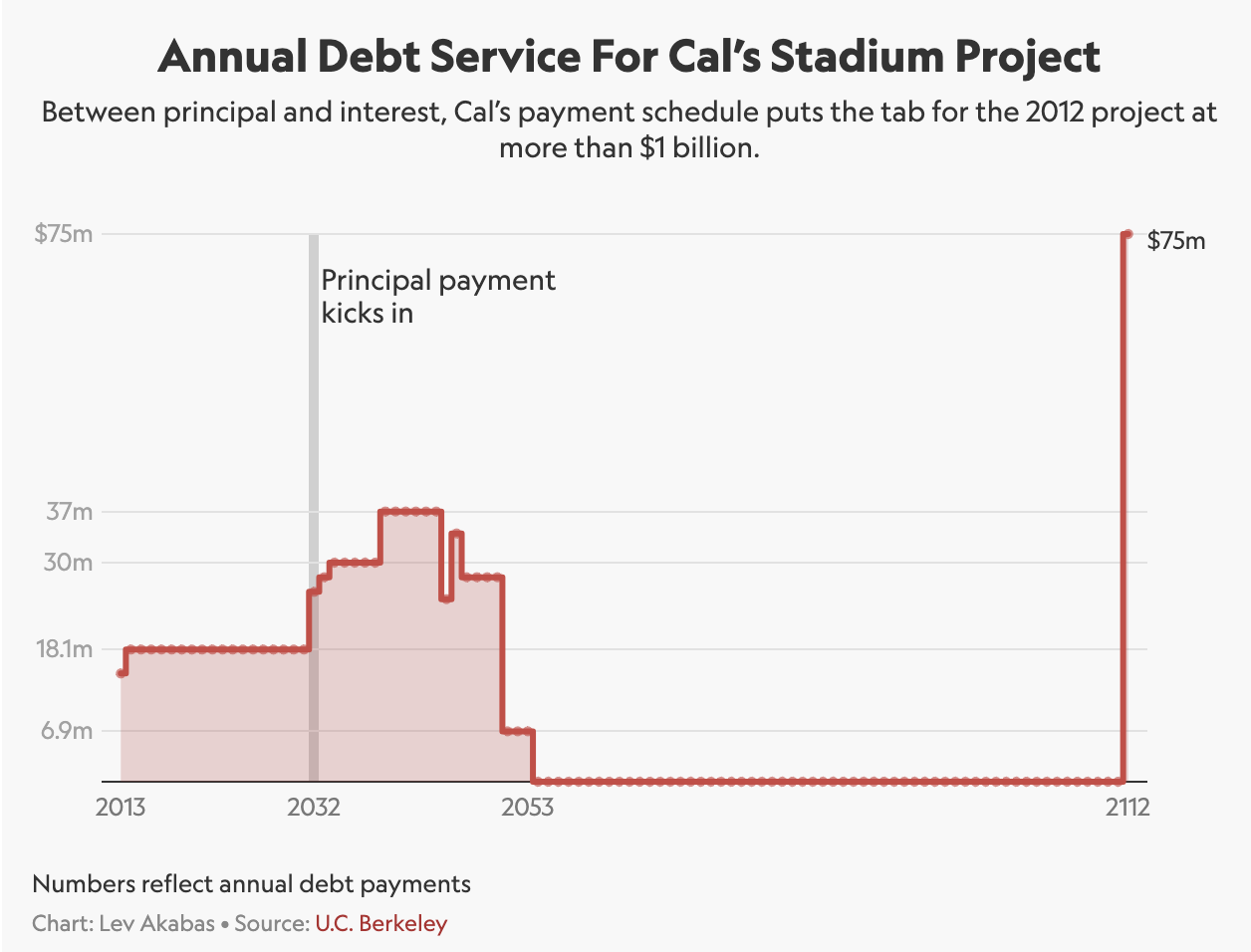

An example of huge renovations being mis-budgeted was Cal Berkley’s athletic program, where they carried the highest athletic program debt of any public school at $438 million which is 36% more than the next closest program. They got to this number because of massive renovations to their football stadium which were financed through borrowing and which they will continue to pay off until 2112 (Appendix 4). Cal offered 30 sports, which is a larger number in comparison to other programs and proved to be extremely expensive as well. If Oregon were to make a critical error like this, it could mean the end for the funding of smaller sports at the school or even worst case scenario, the program as a whole.

The second potential long-term challenge for the athletic department would be an implementation of an Oregon state law that overrules a previous NCAA law that crippled funding for athletics or specifically NIL opportunities. State law will always trump NCAA law, although the possibilities of this actually happening are slim it is worth noting since it would be a potential catastrophe to the large revenue-generating sports.

Our Suggestions:

In order to stabilize the University of Oregon athletic program to prevent these potential challenges, the athletic director should first focus on budgeting future renovations correctly. By doing so, this ensures that all up to date renovations are flexible within the budget and can help map out a long term future for how to relegate money effectively and avoid a situation like Cal Berkeley had to endure.

Our second key recommendation would be to hire staff members who focus on giving our athletes obtainable NIL opportunities and people specializing in contract law. Currently, the University only has two devoted staff members for the entire athletic program who specialize in NIL opportunities for athletes and we feel this number needs to be increased due to both the changing landscape of NIL and the competition other schools will have in taking these opportunities from our athletes. On top of this, in order to stay up to date with the landscape changes, NCAA rules and state laws we would like to hire a group of law school students from UO as interns who specialize in contract law. This allows us to stay up to date and ahead of the curve with this changing landscape, while also frankly finding loopholes within these laws that could allow the athletic program to still strive.

Appendix:

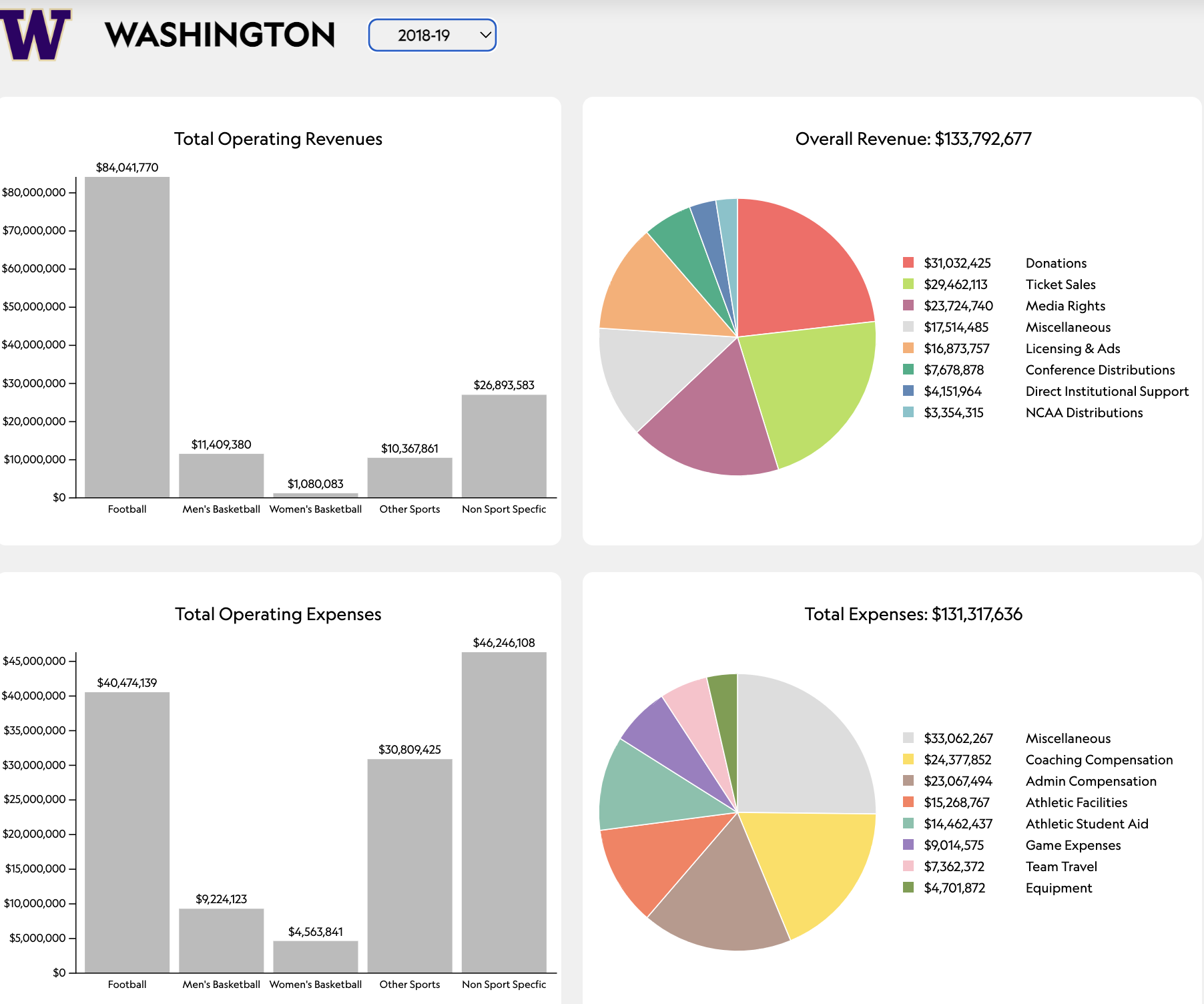

Appendix 1:

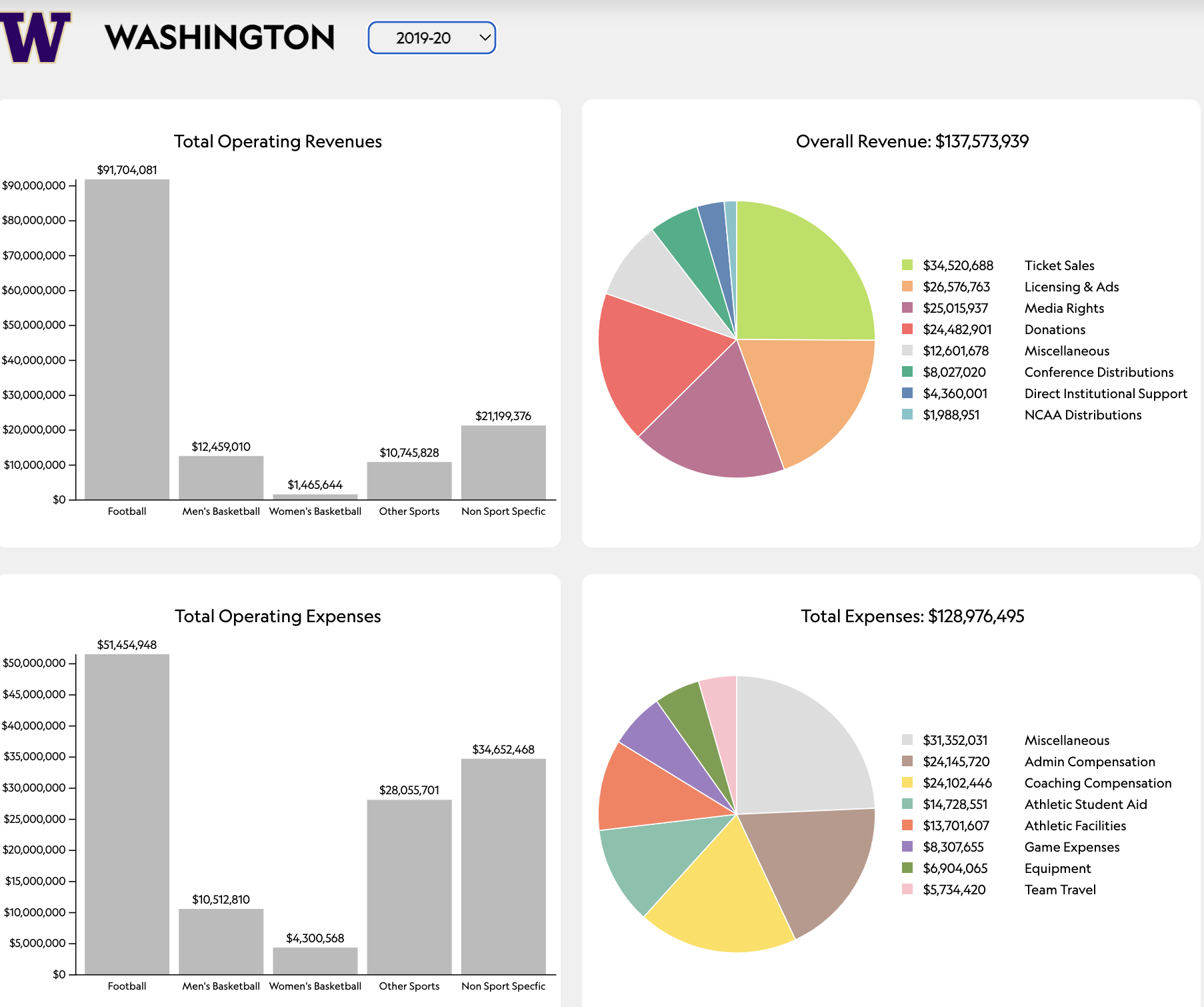

Appendix 2:

Appendix 3:

Appendix 4:

Sources:

Akabas, L. (2023, August 31). Nebraska’s Volleyball Juggernaut is a financial outlier. Sportico.com. https://www.sportico.com/leagues/college-sports/2023/nebraska-womens-volleyball-finances-1234735648/

Football. Oregon Preseason AP Football Rankings | College Poll Archive. (n.d.). https://collegepollarchive.com/football/ap/appearances-preseason-team.cfm?teamid=54

Moseley, R. (2024, November 7). Record crowd sees ducks drop match to Nebraska. University of Oregon Athletics. https://goducks.com/news/2024/11/7/womens-volleyball-record-crowd-sees-ducks-drop-match-to-nebraska

Novy-Williams, E. (2023, August 4). Can the cal golden bears survive a season without football?. Sportico.com. https://www.sportico.com/leagues/college-sports/2020/cal-bears-financial-troubles-1234609207/

Oregon Ducks Poll History: College Football at Sports. Reference.com. (n.d.). ?>https://www.sports-reference.com/cfb/schools/oregon/polls.html

Smith, C. (2024, March 14). College Basketball’s Most Valuable Teams. Forbes. https://www.forbes.com/sites/chrissmith/2012/03/12/college-basketballs-most-valuable-teams/

Staff, S. (2023, December 14). Sportico’s Intercollegiate Finance Database. Sportico.com. https://www.sportico.com/business/commerce/2023/college-sports-finances-database-intercollegiate-1234646029/

University of Maryland Athletics. (2024, December 1). Maryland volleyball record attendance of 13,071 watches no. 2 Huskers top terps. https://umterps.com/news/2024/11/30/volleyball-volley-vs-no-2-nebraska-11-30-24.aspx#:~:text=A%20record%2Dsetting%2013%2C071%20fans,took%20the%20set%20one%20thriller.

Washington Huskies Poll History: College Football at Sports. Reference.com (n.d).

https://www.sports-reference.com/cfb/schools/washington/polls.html